What is Employees' State Insurance - ESI (in India) ?

According to the ESI Act 1948, the scheme applies to all factories and other establishments where the employee strength is 10 or more. (Ref. Govt Portal ) The scheme covers both organized and unorganized sectors

The same rules apply to a non-seasonal factory where the employee count is 10 or more. Furthermore, the applicability of this scheme has been extended to shops, hotels, restaurants, educational institutions, newspaper establishments, cinemas, and private medical institutions since 2001.

Criteria of ESI

However, the employee strength required for ESI registration for factories is 10 for PAN India. For establishments, this threshold is 10 or 20 depending on the state.

Minimum number of employees required for registration of establishment :

A minimum of 10 employees must be registered in a state such as Jharkhand, Kerala, Orissa, Pondicherry, Punjab, Rajasthan, Tripura, Delhi, Karnataka, West Bengal, Andhra Pradesh, Bihar, Chhattisgarh, Gujarat, Haryana, Uttarakhand.

A minimum of 20 employees must be registered in a state such as Himachal Pradesh, Jammu & Kashmir, Madhya Pradesh, Maharashtra, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tamil Nadu, Uttar Pradesh, Arunachal Pradesh, Assam, Goa, Chandigarh, Daman and Diu, Dadra and Nagar Haveli, Andaman and Nicobar, Lakshadweep

Note* : The employee strength criteria may change as per different state government's notifications

How wages are computed for payment of contribution?

Wages – Its the gross income of numerous components, and every entity have different components for gross income. The following wage components are considered for computation of wages for payment ofcontribution.

Inclusions :

a) Basic Pay,

b) D.A/ HRA/ CCA/ Overtime/ officiating allowance/ Night shift allowance/ efficiency allowance/ Heat, Gas, Dust allowance/ Education allowance/ Food & Tea allowance/ conveyance allowance; Overtime

wages (but not to be considered for determining the coverage).

c) Wages/ salary/ pay for weekly off and public holidays;

d) Commission paid to sales staff;

e) Subsistence allowance paid to an employee during the period of suspension;

f) Attendance Bonus or incentive or exgratia in lieu of Attendance Bonus or production incentive;

g) Regular Honorarium or salary or remuneration paid to a Director;

h) Collection Bhatta paid to running staff. Production incentive, Bonus other than statutory bonus,night shift.

i) Actual payments made towards leave salary, lay off compensation, or wages for strike period.

j) Any other remuneration paid or payable in cash to an employee if the terms of contract of employment, expressed or implied were fulfilled.

k) City Compensatory Allowance

Exclusions :

a) Entertainment Allowance

b) Retrenchment Compensation

c) Encashment of leave and gratuity

d) Deduction of health insurance

e) Tax Deductions

Employees of the aforesaid categories of factories and establishments, drawing wages upto Rs.21,000/- a month, are entitled to social security cover under the ESI Act.

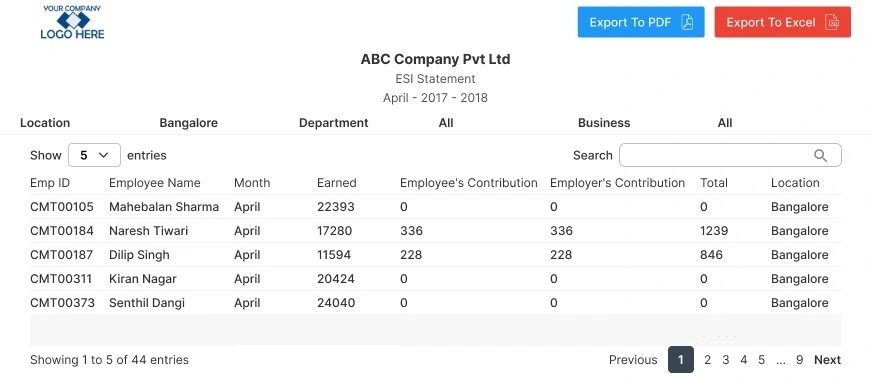

ESI Contribution Calculation

The ESI Scheme is financed by contributions from employers and employees. The rate of contribution by employer is 3.25% of the wages payable to employees. The employees' contribution is at the rate of 0.75% of the wages payable to an employee.

Total ESI Contribution = Employer’s Contribution + Employees Contribution

Contribution calculation as follows:

Let consider Mr. X Working with wages of Rs.17,500 work at factory site.

Employee Contribution – 0.75%*17,500 = 131.25 approx. 132

Employer Contribution – 3.25%*17,500 = 568.75 approx. 569

So, a total contribution of Rs.701 will be made. ( Note - rounded off to the next higher rupee )

Benefits to enrolling for ESIC

There are various benefits to enrolling in this Employees' State Insurance Scheme (ESIC). Here are a couple of examples:

In the event of any certified illness lasting for a maximum of 91 days in any year, sickness benefits at a rate of 70% (in the form of compensation) will be provided.

Medical coverage for an employee and his family.

Maternity leave is available to pregnant women (paid leaves).

If an employee dies on the worksite, 90 percent of their wages is paid to his/her family every month for the rest of their lives.

The same regulations apply if an employee becomes disabled.

Funeral expenses, Medical costs for the elderly.